Built Worlds Venture West 2023 – 5 Key Takeaways

The Blackhorn team recently returned from participating in BuiltWorlds”s Venture West, one of the pre-eminent events focused on venture investing in construction and built environment-related emerging technology. Aside from reconnecting with a number of friends and co-investors at WND Ventures, Zacua Ventures, Cemex Ventures and corporate innovation leads at Owens-Corning, St. Gobain, Vinci and more, the gathering informed five key takeaways that make us even more excited about the growing startup ecosystem in the built environment.

Construction Tech’s Growing Opportunity

-

- Despite an increasingly high interest rate environment, construction volume is growing. The AIA’s Consensus Construction Forecast panel—comprising leading economic forecasters—is projecting nonresidential construction spending to grow 5.8 percent 2023.

- There is $450Bn of opportunity in potential productivity gains through digital transformation.

- Construction volume is actually increasing in 2023 compared to. 2022 even in the face of steeply higher interest rates

Residential

-

- New single family house construction is off by about 18% nationwide, but volume is growing in Texas, Florida and SoCal.

- Multifamily housing built to rent is growing quickly.According to a recent Fannie Mae study, the vast majority of metro areas in the United States suffer from a lack of affordable single-family housing for both renters and homeowners, with a cumulative affordable housing shortage estimated at about 4.4 million total units.

Non-Residential

-

- Non-residential construction sub-sectors–infrastructure, manufacturing, including data centers, and infrastructure–are growing. Despite macroeconomic headwinds such as inflation, rising interest rates, and weak consumer sentiment scores, the AIA’s Consensus Construction Forecast panel—comprising leading economic forecasters—is projecting nonresidential construction spending to grow 5.8 percent in 2023

Corporate Venture Plays a Critical Role in Real Estate Technology

-

- Corporate venture has continued to move earlier and earlier.Between 2010 and 2020, the number of CVCs grew more than six times to over 4,000, and at the height of the cycle these CVCs inked more than 2,000 deals worth $79 billion in the first half of 2021, surpassing all previous annual tallies. Investment not only derisks potential future M&A, but also provides insights via exposure to trends ahead of the competition.

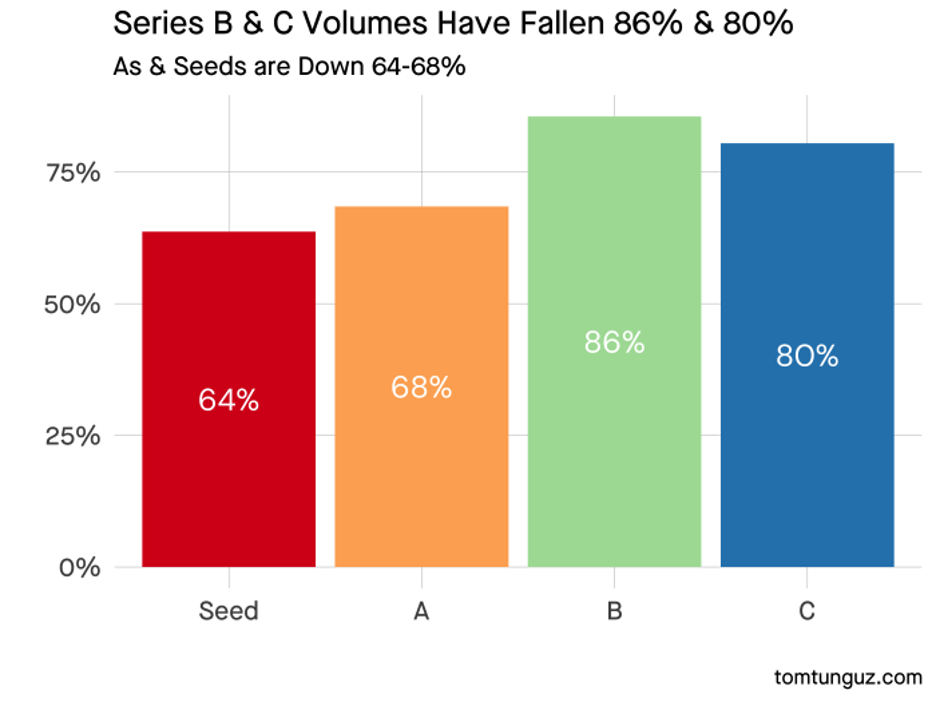

- Seed and A rounds are occurring at volumes comparable to previous years

- CSVs of firms like ProCore, Autodesk and Trimble are making more investments in early stage startups and watching to see whether they can grow, vs. acquiring them early on.

- There is a trend toward flat Seed and A round extensions, and flat or down B, C and later rounds, vs.successive up-rounds at increasingly higher valuations

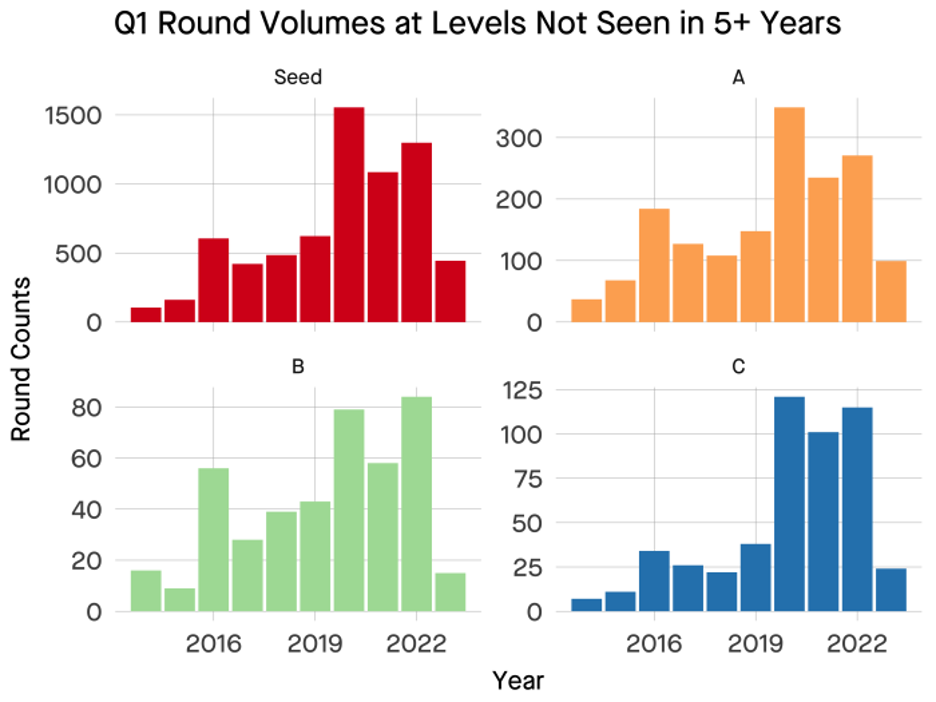

- The hardest round to raise so far in 2023 is the Series B. Although, all the early & mid-stage rounds have fallen to levels not seen for 5-10 years.

-

- Q1 volumes by year show broad declines across early-stage venture capital. Seeds peaked at 1500 in Q1 of 2020 falling to 155 in Q1 of 2023.

Capital-Efficient Pre-Fab Solutions are Experiencing Strong Tailwinds

-

- Labor shortages persist and are worsening, which is leading to higher wages.

- High interest rates on construction loans are a tailwind for prefab, which accelerates time to completion and rollover into lower cost mortgage financing

- Sustainability and Safety concerns are further tailwinds for prefab, which creates 30%-40% less GHG emissions than onsite construction and is safer (McKinsey Study).

- The prefab panel at BuiltWorlds Venture West generally supported Blackhorn’s prefab investment thesisof capital-light prefab solutions that:

- automate the work of a single-trade, or

- design a set of flexible modular components (“kit of parts”) and orchestrate an outsourced supply chain to manufacture, assemble and install the modules.

Data Sharing for a Fragmented Industry

-

- While keynote Di-Ann Eisnor, ex-WeWork and Google/Waze and current CEO at Crews by CORE asked the crowd of corporates to refrain from ‘death by pilot’, there is a real need to share results from pilot testing across the industry.

- Unlike other heavily regulated sectors, the construction industry does not have an industry standard, or peer reviewed journal of record where data gets shared from customer to customer, or from region to region.

- Entities like BuiltWorlds are natural conveners. They can serve as a data repository and marketplace from their members like DPR and other large engineering and construction companies who are running multiple pilots to help accelerate deployment of startup solutions that are exceeding their corporate sponsor mandates.

Deeper on Decarbonization

-

- Real estate drives approximately 40% of global carbon emissions. If we’re to reach net zero by 2050, and keep temperature rise in line with the targets put in place as part of the Paris Accords, we’ll need to rapidly decarbonize our buildings.

- Despite increased interest in sustainable real estate and the opportunities it presents to capitalize on and future-proof assets, only a fraction of the teams we met at the show were focused on using novel tools like AI and ML to decarbonize real estate.

- There is a well-worn cow path for startups working on pre-construction, site analysis and optimization, materials marketplaces, and construction finance.We’ve seen dozens of the same companies pursuing the same opportunities that have little to no potential impact on emissions reduction. Many of these early-stage Founders would be well served drilling into their competitive landscape and getting a better handle on their unique advantages around customer acquisition.

- Buildings that are heavy emitters are increasingly viewed as at risk of becoming ‘stranded assets’.Our single process automation thesis for pre-fab modular construction implies a significant emissions reduction opportunity. With recent large funding rounds from BlocPower and Logical Buildings, and funds like Fifth Wall putting real dollars to work, the demand for scalable retrofit solutions are growing, with market pull coming from institutional investors, homeowners, municipalities, and utilities. A Blackhorn portfolio company, Ecoworks, based in Berlin, is a textbook example of a capital-efficient prefabrication business model to upgrade energy efficiency of old, energy-wasting and GHG-emitting apartment buildings.